At some point in life, any of us may face a challenging situation and find ourselves in need of a helping hand. When you donate to the fund, you are helping others recover from times of crisis. Your donation will have a lasting impact for individuals who experience a devastating event.

“Thank you so much for this grant, it will help greatly with my bills. You have no idea how thankful I am for this and to all of my coworkers who gave to the program!”

- Grant Award Recipient

E4E Relief is a 501(c)(3) public charity. E4E Relief's tax ID number is 87-3137387. With more than two decades of experience serving clients, E4E Relief is the nation's leading provider of employee disaster and hardship funds.

While donations cannot be designated for a specific individual, country (location), or event, they do guarantee funds are available to provide assistance to individuals in need who meet the criteria of the program.

A donation to your relief fund administered by E4E Relief may be tax-deductible, provided no goods or services were received in exchange for the donation. You will receive an emailed tax receipt for credit card and cryptocurrency donations. For any other gifts a gift acknowledgment will be provided for all those, $250 or more, made directly to the Fund via E4E Relief. Cash gifts, depending on the amount, may or may not require a receipt for tax purposes. Please check with your tax advisor for more information.

Donations to the Relief Fund are voluntary and are not required to apply for assistance.

Yes, our relief programs currently accept gifts from outside the U.S. However, we restrict sanctioned countries based on guidance from the Office of Foreign Assets Contract (OFAC).

Upon completion of your donation, you will receive a tax receipt for any crypto or credit card donations made through the donation form. An acknowledgement receipt is provided for the pledge of stock and DAF donations.

For stock donations, tax receipts for donors will be handled by our third-party partner - Renaissance Charitable Foundation (Ren).

For DAF donations, tax receipts are provided by the nonprofit handing the gift transaction.

Credit Card donations take 3-5 business days to be received into the fund.

Crypto donations take 2-5 business days for the transfer to be completed and received into the fund.

Timing to receive the funds on stock gifts will depend on how fast the donor’s broker can process the transaction and move the shares, which can take up to 2-3 weeks for processing.

Depending on the provider, we will receive the DAF donations anywhere between 1-3 weeks.

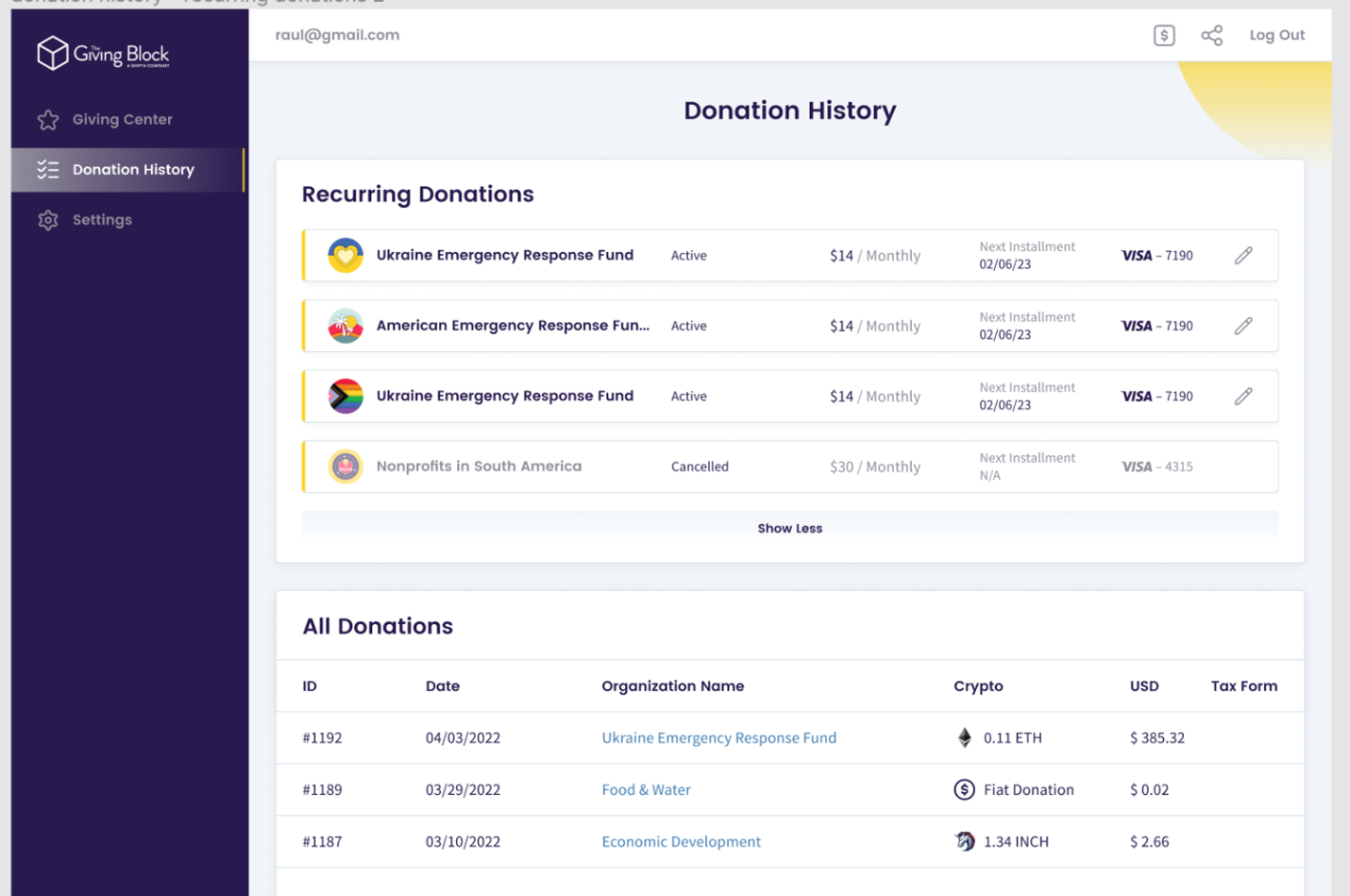

You may review historical donations through your portal under ‘My Donations’ or by accessing The Giving Block donor dashboard. You will need to create an account using the same email address used when making the donation. This user ID and password IS NOT necessarily the same for your program portal, but a unique login with The Giving Block.

Once you login to The Giving Block Donor Dashboard, you can access any receipts related to your previous donations.

Once you login to The Giving Block Donor Dashboard, you can view your donation plans and update information related to your credit card and frequency of payments. You can also turn off any recurring donations here. Recurring donations cannot be made anonymously for regulatory reasons.

For information about other ways to give, please contact E4E Relief Donor Services at 704-973-4564 or donorservices@e4erelief.org.